As a development banking institution in Mexico, BANSEFI, in concert with the financial sector, responds to the need for financial services through mechanisms that stimulate financial inclusion. Thus, in an effort to offer financial products and services to co-nationals returning to the country due to a repatriation process, 12 service modules have been installed to offer many financial services.

Innovation Summary

Innovation Overview

In view of the current situation of Mexicans in the US, a series of actions are being implemented to further protect the rights of our co-nationals in said country, as well to offer both Mexicans abroad and those who have returned to the country access to different federal government programs and support. The repatriation of co-nationals is done at the Points of Repatriation established by the INM along the borders, and at the Mexico City Benito Juárez International Airport. The busiest points are Tijuana, Mexicali, Nogales, Ciudad Acuña and Nuevo Laredo.

According to the INM’s experience, returnees generally arrive without any belongings, but sometimes with money. Their main requirements to enter Mexico are:

a) work

b) health insurance

c) financial services.

In order to participate in public policy on migrant protection, BANSEFI aims to enrich migrants by offering them financial information that facilitates decision-making and enhances the use of financial services.

Therefore, BANSEFI created the Financial Inclusion Program for Migrants to encourage co-nationals in the process of repatriation to open savings accounts that offer them more security and thus enhance their access to various products, programs, and financial services.

Innovation Description

What Makes Your Project Innovative?

This program is new and there is no public policy on financial inclusion for migrants. This program consists of offering repatriated co-nationals access to financial products and services, as well as financial education, specifically designed to meet their needs and give them access to formal financial mechanisms under better financial conditions. The main purpose of the program is to reduce the vulnerability of this segment of the population by offering them tools that allow them full financial inclusion by opening savings accounts.

Generally speaking, the program seeks to improve the co-nationals quality of life. Specifically, it intends to:

• Contribute to the federal government program as a development bank by offering the support and guidance co-nationals need to generate financial inclusion.

• Stimulate financial inclusion, increasing the availability of financial products and services that allow co-nationals to have options to deal with their current situation and improve their quality of life.

•Encourage more efficient use of the financial instruments available and offer co-nationals greater security.

•Create tools and knowledge that allow co-nationals to make better decisions and improve their well-being and productivity.

This program is unique because the National Banking and Securities Commission has authorized the use of the Certificate of Admission of Repatriated Mexican Citizens issued by the INM at bank service modules at the points of repatriation as an identification document and proof of residence. In this way, returnees can open a sight deposit account in national currency, as well as carry out transactions in terms of money exchange for a monthly maximum accumulated amount of $4,000 USD.

What is the current status of your innovation?

It is estimated that there are currently 34 million people of Mexican origin in the US, 11 million of whom were born in Mexico. More than a quarter of all the migrants born in Mexico are concentrated in three cities: Los Angeles, Chicago, and Dallas, with 1.7 million, 684,000 and 610,000 migrants, respectively. (Source: Mexican Senate, January 25, 2017). The Mexican Federal Government calculates that the US government repatriation plan will affect approximately 1 million co-nationals, as well as 585,000 Mexican youth or dreamers who are currently protected by work or study permits under the Deferred Action for Childhood Arrivals or DACA program. (Source: Mexican Senate, January 25, 2017) Mexico’s 2014.

Financial Reform reframed the role of development banking to provide more and better financial services to the population excluded from the formal financial system. Such people include the migrant population, which is considered a vulnerable group and has historically had to face a number of barriers to gain access to financial services, whether due to a lack of knowledge, a lack of information, their immigration status, or simply finding themselves in the process of repatriation. In view of this situation, BANSEFI takes part in the financial public policy to protect migrants by allowing them to maximize on the resources obtained regardless of their situation and promoting financial inclusion through the “Financial Inclusion Program for Migrants”.

The scope of the program includes the following products and services:

• Financial Education: through advisory services and promotional material, we seek to provide co-nationals with information and advice about personal finances so they can make good use of and adequately manage their resources.

• Savings: Based on the profiles and financial preferences of our co-nationals, BANSEFI places at their disposal a banking product that consists of a sight deposit account specifically designed for them, with clear incentives encouraging them to save. It is a byproduct of the co-national cardholders can automatically have access to the following coverage at no extra charge: • Life insurance linked to the bank card that includes coverage of up to $750 USD per insured person in case of an accident, dismemberment or paralysis, as well as an accidental death. • Funeral cost assistance in the event of the accidental death of the cardholder for up to $7,500. •Additional Services: the program provides for additional services available for co-nationals.

• International remittances: This service aims at offering co-nationals immediate benefits when receiving money from the United States through remittance agents that have signed service agreements with BANSEFI. These international remittances are deposited in the accounts opened through BANSEFI and the funds can be withdrawn at BANSEFI branches, as well as community-based savings and loan associations members of L@Red de la Gente.

• Money exchange: money exchange services will be offered to co-nationals who need to

exchange US dollars. This transaction can be carried out through BANSEFI delivery channels for financial products and services

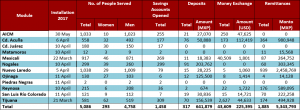

• Service modules for co-nationals located at INM offices

• Branches for financial service transactions: upon having opened an account at a Service Module, as part of the program implementation strategy, and to make the process more efficient and lower the cost for program participants, the intention is to have co-nationals formalize program products and services at the modules set up at INM offices. These modules have been set up at 11 points of repatriation located along Mexico’s northern border: • Baja California (Tijuana - San Isidro / Mexicali – Calexico). • Sonora (San Luis Rio Colorado – Yuma / Nogales – Nogales). • Chihuahua (Cuidad Juarez-El Paso /Ojinaga – Presidio). • Coahuila (Ciudad Acuña – Del Rio / Piedras Negras – Eagle Pass). • Tamaulipas (Matamoros – Brownsville / Nuevo Laredo – Laredo / Reynosa – Hidalgo). One module was also set up at the Mexico City International Airport (AICM).

Innovation Development

Collaborations & Partnerships

Collaboration for the Financial Inclusion Program for Migrants has been attained through the “Somos Mexicanos” strategy implemented by the Ministry of the Interior in 2014 and run by the INM at 11 points of entry along Mexico’s northern border and at the Mexico City International Airport.

This strategy aims at offering comprehensive assistance to Mexican citizens repatriated from the United States. This assistance consists of several actions provided by different agencies that directly or indirectly address the return phenomenon so that the returnees can become a part of national life and contribute to Mexico’s development. The innovation BANSEFI has developed makes it possible to enhance the range of program services through inter-institutional collaboration.

Users, Stakeholders & Beneficiaries

Within the framework of the Somos Mexicanos Strategy, BANSEFI signed a Collaboration Agreement with the National Migration Institute on May 30, 2017. This agreement aims at coordinating all mutual collaboration activities.

Innovation Reflections

Results, Outcomes & Impacts

The financial services offered at the modules have been well-received by co-nationals going through the repatriation process. It is believed that the social and financial inclusion of returnees will have a significant impact on family well-being and Mexico’s development.

Challenges and Failures

The main challenged faced in the program’s implementation was the limited time frame. All of those involved had a response time of approximately two months and the program was fully implemented two months later. In other words, it took place within a period of four months. For proper attention, all the available resources were used and adapted to the needs of this program.

Conditions for Success

In order to successfully implement this type of program, it is essential to have a team ready to respond to any needs that might arise. The leading role of the higher authorities is a necessary requisite. It is also imperative to implement a series of inter-institutional coordinating offices and for all those involved to understand the importance and scope of the project.

Replication

We believe that the service given to returnees at entry points to Mexico can be replicated under similar situations or conditions, as in the case of persons seeking asylum in the country who do not have official documentation to open an account. This would be a way to exploit the existing infrastructure and the knowledge gained from the program.

Lessons Learned

The program has met its objective. As an institution belonging to the Development Bank, BANSEFI does not intend to benefit financially from the implementation of this kind of initiative. However, as a State-owned company, it needs to find a balance between the income generated and the expenses incurred when implementing this type of action. So far, there is not enough information to evaluate the financial profitability of these modules. More work must be done in the medium term on this aspect to determine whether to continue as it was implemented or if adjustments are needed.

Status:

- Implementation - making the innovation happen

Date Published:

13 May 2017