LBChain is a blockchain-based technological sandbox which combines regulatory and technological infrastructures and allows start-ups to test their business solutions in a controlled environment. The platform will enable start-ups to gain new knowledge, carry out blockchain-oriented research, test and adapt blockchain-based services and offer state of-the-art innovations to their customers.

Innovation Summary

Innovation Overview

As the central bank and financial market supervisory authority, the Bank of Lithuania is primarily responsible for the regulation and supervision of market participants in accordance with applicable legal acts and requirements. Development of a fintech-conducive regulatory and supervisory ecosystem as well as fostering innovation in the financial system is one of the Bank of Lithuania’s strategic directions. Together with other state authorities, the Bank of Lithuania contributes to the development of new growth opportunities for fintech market participants by creating and maintaining a supportive environment, stimulating competitiveness and innovations in the field of finance.

LBChain is a blockchain-based technological sandbox which combines regulatory and technological infrastructures and allows start-ups to test their business solutions in a controlled environment. The platform will enable start-ups to gain new knowledge, carry out blockchain-oriented research, test and adapt blockchain-based services and offer state of-the-art innovations to their customers.

By creating LBChain, the Bank of Lithuania seeks to:

* Create conditions for fintech to acquire know-how and conduct applied research;

* Facilitate the validation of experimental applications and solutions;

* Enable the exploration of development trends of disruptive technologies;

* Stimulate the demand for innovations and introduction of new products to the market;

* Improve the competitiveness of Lithuania and attract foreign direct investments (FDI).

To improve financial market regulation regulators needs to understand new blockchain based products form the core. LBChain – blockchain sandbox allows regulators work together with start-ups from the beginning of their idea and grow competence in new blockchain based financial products. For the start-up working with regulators from early stages of the product accelerates the development of their product and helps go to the market faster and with less expenses, and regulatory compliant. That brings the competitiveness to the financial market and the customer benefits from it.

Central goals of LBChain are: accelerate the development and application of blockchain-based solutions in the financial sector and improve the quality of regulation in the financial sector.

To create innovation sometime process of creation become innovation. For government institutions it is very hard to purchase innovative solutions because of complicated public procurement process. At the Bank of Lithuania we chose pre-commercial procurement (PCP) to create LBChain – blockchain sandbox. PCP is the method where public institutions and product suppliers co-create together, where public institution provide the need, hypothesis, and product suppliers provide their knowledge and resources needed to implement the idea.

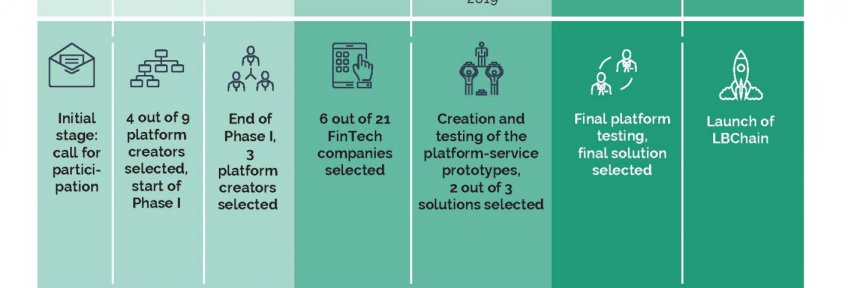

The unique thing in PCP is competitive development in phases: procuring body buy R&D from several competing suppliers in parallel (LBChain case: UAB Inntec, UAB Deloitte verslo konsultacijos, UAB Tieto Lietuva, IBM Polska Sp.z.o.o.) to compare alternative approaches and identify the best value for money solutions that meets procuring body’s needs. PCP is split into three phases (solution exploration, prototyping, original development of a limited volume of first products) with the number of competing solution providers being reduced after each PCP phase.

Innovation Description

What Makes Your Project Innovative?

According to the survey made by Deloitte in the first phase of LBChain pre-commercial procurement, LBChain is unique product in the world because of blockchain test environment and blockchain consultations and support provided by the Bank of Lithuania. Central banks operating regulatory sandboxes that covers regulatory consultations, but for the technical environment where the fintech test case will be deployed and demonstrated is the responsibility of the fintech itself. LBChain provides regulatory consultations and support, same as regulatory sandbox, and technical test environment for fintech where fintech can create and test its solution and Bank of Lithuania specialist provide consultations on technical issues.

What is the current status of your innovation?

In LBChain project we are stepping into end of third phase (development of a limited volume of first products). Market research and prototype was already implemented. Prototype in second phase was tested (LBChain participants (fintech companies) created prototypes of their products and tested them in technical blockchain platform provided by LBChain and get regulatory and technical consultations from LBChain team) with six different fintech companies. Products tested in LBChain: KYC solution for AML compliance, cross-border payments, smart contract for factoring, mobile POS and payment card solution, unlisted share trading platform, crowdfunding platform, payment token. Another seven companies were selected to test LBChain in third phase of the project. Product being tested in LBChain third phase are: asset tokenization, payments, regulatory compliance, security token exchange platform, issuance of green bond.

Innovation Development

Collaborations & Partnerships

LBChain is co-funded from EU structural funds. Lithuania Business Supporting Agency and Agency for Science Innovation and Technology were evaluating application and performing the monitoring of the project.

Pre-commercial procurement participants (market research and prototype creation): UAB Inntec, UAB Deloitte verslo konsultacijos, UAB Tieto Lietuva, IBM Polska Sp.z.o.o.

Invest Lithuania – communication and attraction of LBChain participants.

Users, Stakeholders & Beneficiaries

Society - LBChain helps attract FDI, and foster competitiveness in financial sector;

Bank of Lithuania – growth of internal blockchain and pre-commercial procurement competence;

LBChain participants – faster and with less expenses go from idea to the market;

LBChain suppliers - growth of internal competence, IPR of created product.

Innovation Reflections

Results, Outcomes & Impacts

Global market research has been done, prototype created and tested with six companies. The criteria for success of each pre-commercial procurement phases is detailed in pre-commercial procurement conditions, Annex - technical specification. The results after each phase have been evaluated by the Bank of Lithuania experts and external Agency for science, innovation and technology.

Impact to society or other stakeholders/beneficiaries it is not possible to measure in such early phase of the project.

LBChain already served 13 participants (37 companies express their interest to participate in LBChain). 4 companies are Lithuanian, 2 participants opened their company branch in Lithuania and get licenses, and another 2 companies are planning expanding their business to Lithuania.

In the future impact of LBChain could be measured by the licenses issued in Lithuania.

Challenges and Failures

One of the biggest challenges was to attract LBChain participants to test prototype in third phase of pre-commercial procurement. After success in second phase where we got 22 applications (most of them form Lithuania) to third phase we try to attract companies from other countries. Challenge was to reach target audience.

PCP itself is a challenge for the suppliers, because it is innovative and not usual way to purchase R&D services, suppliers briefing and managing work with them was a challenge in the beginning of PCP.

All failures and challenges have been responded, some failures cost extension of project timeline, but it did not impacted the results.

Conditions for Success

As every innovation strong leadership, personal values and motivation of the team is essential. Project needs to have employee in the organization who is driving that project. In LBChain case infrastructure and policy was key components that helped innovation to occur. Without pre-commercial procurement we will not be able to reach such results.

Replication

Such innovations like LBChain could be replicated by other government (supervisory) institutions. As we know it is not been replicated, but there are some similarities with non-government private sector initiatives. But the Central bank (or other supervisory body) role is essential in such innovation like LBChain.

Lessons Learned

During the first phase (fintech market research and concept development) we found that for fintech companies’ network/solution partners identification and KYC/AML procedures for customers is essential and rated higher than assumptions of public blockchain protocols of nodes anonymization, decentralization and distribution across geography. That’s why we chose to use enterprise blockchain platforms (Hyperledger Fabric and Corda).

We investigated usage of blockchain platform interoperability and found that in LBChain we need to organize it as multi-platform where two or more blockchain platforms do not need to exchange information between each other.

Working with LBChain participants (fintechs) require broader competence than only financial market supervision and blockchain technology. Business development and other legal issue (e.g. GDPR) are also very relevant for fintechs.

It is difficult to manage PCP process because of a lot of uncertainties in the product and hypothesis based technical specification, usually it caused extension of the timeline.

Supporting Videos

Status:

- Implementation - making the innovation happen

Files:

Date Published:

5 August 2020