A savings Program that is designed to encourage savings and financial literacy amongst Saudi children and providing financial inclusion for Young Saudi population (>18) from an early age and encouraging them to save and achieve their goals by providing attractive incentives and rewards and leveraging fintech best practices while applying behavioural economics.

Innovation Summary

Innovation Overview

Saving is one of the priorities of the Social Development Bank in accordance with the tasks and objectives entrusted to it in its mandate,“Working to encourage thrift and savings for individuals and institutions in the Kingdom, and finding tools and programs that achieve this goal.” From this standpoint, the bank took the initiative to work on developing several strategic options to activate saving, including: - developing savings programs and products and strengthening financial literacy and raising household savings.

Due to insufficient financial planning behaviours observed among youth, leading to difficulties managing money, saving. and investing wisely in adult stage

It is important to instil appropriate financial behaviours from an early age to ensure the future adults can make informed financial decisions and manage their finances accordingly.

Hence, Zood Alajyal was launched in 2021, as a financial inclusion and savings tool for the younger Saudi population to encourage savings behaviours from an early age.

It is an innovative savings solution for children and teens aged 6-18 years that enables them to have an integrated banking experience under the supervision of their parents and helps them manage their daily expenses and save and raise their level of financial culture.

The program has benefited the community by encouraging savings behaviours in children by providing attractive incentives and rewards. Improving their skills in dealing with money and acquiring sound financial habits that will help them in the future in managing their financial affairs.

With 50,000 boys and girls benefiting from the program, the value of the participating children’s savings has exceeded $2 million USD

Using data and analytics to measure the program’s performance indicators on a weekly basis and doing the necessary analysis of the data on the participants’ savings behaviours and their interaction with the educational content in the program to determine the extent of the program’s impact on the participants and the extent to which the program achieves its goals.

SDB has designed the savings products in a unique way using some behavioural economics principle to nudge some behaviours and to avoid certain biases that could influence the decision-making processes of individuals. We have applied these principles to the customer's whole journey starting from application process and during the program duration.

The application process is fully automated to overcome inertia as behavioural economics suggests that people are cognitively and emotionally tends usually to avoid complicated and long application process.

Incentives scheme is designed based on behavioural economics concepts. Paid monthly, based on child’s cumulative savings. It is designed to nudge them to save regularly, as most people tend to avoid losses more than their desire to achieve similar gains, and they tend to choose smaller rewards immediately rather than wait for larger rewards later

Innovation Description

What Makes Your Project Innovative?

SDB has designed the savings products in a unique way using some behavioural economics principle to nudge some behaviours and to avoid certain biases that could influence the decision-making processes of individuals. We have applied these principles to the customer's whole journey starting from application process and during the program duration.

The application process is fully automated to overcome inertia as behavioural economics suggests that people are cognitively and emotionally tends usually to avoid complicated and long application process.

Incentives are designed to be attractive and paid monthly based on customers’ cumulative savings, in addition to offering a final incentive for being a regular saver on the program. The incentives' structure is designed to nudge people to save regularly, as most people tend to avoid losses more than their desire to achieve similar gains, and they tend to choose smaller rewards, but immediately rather than larger rewards later.

What is the current status of your innovation?

The program has been active since 2021 and currently has over 50,000 participants.

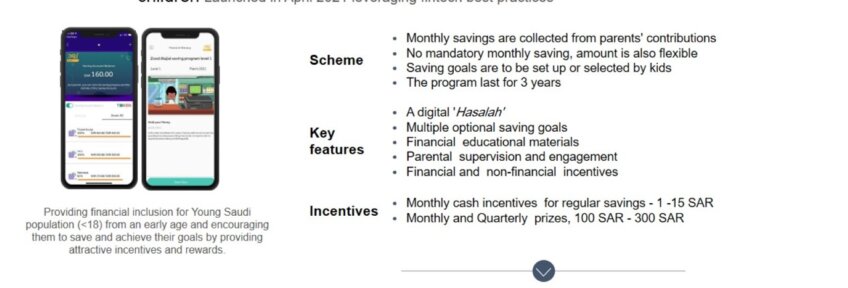

1-The applicant should be between the Age (6-18).

2-Provided to customers with the collaboration of number of partnering banks.

3-Easy online registration in 2 minutes through the parent's bank account.

4-Program duration is 3 years.

5-The ability to create multiple savings goals.

6-The program provide full banking experience for children by providing current account, savings wallet, savings with goals, in addition to a payment card.

7-The program provide financial literacy materials.

8-Flexible savings amount and no obligatory Monthly contribution.

9-Monthly cash incentives (1 SR for each 10 SR) Max. 15 SR monthly

10-Monthly and Quarterly prizes, 100 SAR - 300 SAR (to be qualified for the prizes you should meet one or more of the following: interacting with financial literacy materials/ setting and achieving goals/regular saving behaviour).

Innovation Development

Collaborations & Partnerships

Fintech represents an important part of the project, which requires alignment between all partners by establishment of a steering committee represented by key internal and external stakeholders. They met on a weekly basis to ensure that the project is progressing correctly and to ensure the participation of all stakeholders in all stages of the project, which helps in accelerating the decision-making process and overcoming problems and obstacles faster.

Users, Stakeholders & Beneficiaries

Key stakeholders include, Social Development Bank, Minister of Social Development and Human Resources, National Development Fund, Saudi Central Bank, Financial Sector Development Program, National Savings Committee, Commercial Banks, and the Saudi public.

Users and beneficiaries are Saudi children aged 6 to 18 years and their parents or legal guardians.

Innovation Reflections

Results, Outcomes & Impacts

•Enabling approximately 50,000 customers (children) to save through their savings accounts in the program.

•Spreading the culture of savings and financial awareness to Saudi families, as it is estimated that more than 100 thousand individuals have been reached through the program.

•The value of the participating children’s savings until end of 2023 has reached over $2 Million USD.

•Over 30% of participants interacted with the financial culture content in the program.

•Filling the gap in the market in savings programs directed to children in the Kingdom.

The impacts have been measured using analytical data and observations in participants interactions and saving behaviours.

Challenges and Failures

•Harmonization between the Social Development Bank and the financial partners in setting the plans for completing the project stages.

•Overcome time constraints and developing an appropriate and effective communication plan.

•Intersections with relevant authorities regarding internal approvals or legislative authorities.

•Due to the presence of many complications in the dependencies during the technical development stage between the relevant parties

The project management team have identified and communicated the issues promptly, assess their impact, developed alternative solutions, involved stakeholders, adjusted timelines, when necessary, allocated resources effectively, and continuously monitored and adapted the project plan.

Conditions for Success

Such an innovation must include clear objectives aligned with goals, strong leadership and stakeholder support, adequate financial and human resources, stakeholder engagement, supporting government policies and regulations, collaboration and partnerships, flexibility, evaluation and learning mechanisms, a supportive culture, effective communication, and a focus on sustainability and scalability.

Replication

There is great potential for replicating this innovation elsewhere in the region. But there must be supporting factors in place, such as the availability of necessary resources and capabilities, the level of stakeholder support, the adaptability of the innovation to local conditions, the existence of appropriate policies and regulatory frameworks, and the willingness and capacity of other organizations to adopt and implement the innovation.

Lessons Learned

- It is crucial to have regular meetings and workshops with team members and relevant stakeholders.

- It is of great value to conduct survey polls and gather the community’s opinions and views.

- Focus groups that will add value and insights to the project.

- Lessons learned were reflected in the preventive and corrective actions taken. Return and review when issues occur.

Anything Else?

The program is contribution to achieving the third pillar of the strategic goals of the Financial Sector Development Program (one of the Kingdom’s Vision 2030 programs), which stipulates “promoting and enabling financial planning (retirement, saving, etc.)”

The positive social impact that on the financial behaviours of children, in addition to raising awareness, so that in the future we will have a generation that is more capable of managing their financial affairs, as the level of financial literacy among individuals in the Kingdom is low compared similar countries in the G20.

Filling the gap in the market in savings products aimed at children, encourage their saving behaviours, and improve their skills in dealing with money.

Project Pitch

Supporting Videos

Status:

- Implementation - making the innovation happen

Files:

Date Published:

2 July 2024