Innovation Portfolio Management for International Development Organisations – Part 1

Innovation portfolio management enables not only commercial actors but also public sector organisations to systematically manage and prioritise innovation activities according to concurrent and diverse purposes and priorities. It is a core component of a comprehensive approach to innovation management and a condition to assess the social return of investment across an entire portfolio. The OECD Observatory of Public Sector Innovation (OPSI) has worked in this space for a number of years. By gathering the latest innovation portfolio management knowledge and practices, we developed the Innovation Facets model as well as interactive workshops and digital tools to support public sector organisations and civil servants in OECD Member States to enhance innovation management. In 2022, OPSI teamed up with the relatively young ‘OECD Innovation for Development Facility’ to adapt this work to the international development sector, with a particular focus on supporting development funders and members of the OECD Development Assistance Committee.

Key considerations

Investments in international development innovations have transformed the lives of poor and vulnerable people over the last decades. From cash transfers to vaccines and mobile banking – innovation has played and continues to play an important role in international development. Despite the impact of many successful innovations in development co-operation, there are few examples of international development organisations that are consistently and systematically innovating and scaling interventions over prolonged periods of time.

Innovation portfolio management for international development organisations differs from its application to other public sector organisations and administrations. Development organisations work in complex and dynamic environments, and funders usually support local partners as well as international organisations to implement innovation activities on the ground.

In addition, development organisations must balance the needs and expectations of their complex set of stakeholders. This includes expectations from taxpayers and the public in donor countries as well as supporting local change-makers without overburdening them with reporting and other administrative requirements. A portfolio approach to international development facilitates better balance of risks and rewards. It enables an organisation to take stock of the social return of investment across an entire portfolio, as opposed to limiting evaluations to single innovations and projects. For example, USAID’s assessed the entire portfolio of its Development Innovation Ventures portfolio assessment found an overall 17:1 social return on every US-dollar invested. While 41 innovations were supported over a 2.5-year period, the success of this number was attributed to just five high-performing innovations. That is the value of a portfolio approach to innovation. Having one’s fingers in many pies as a way to maximise rewards.

The OECD service

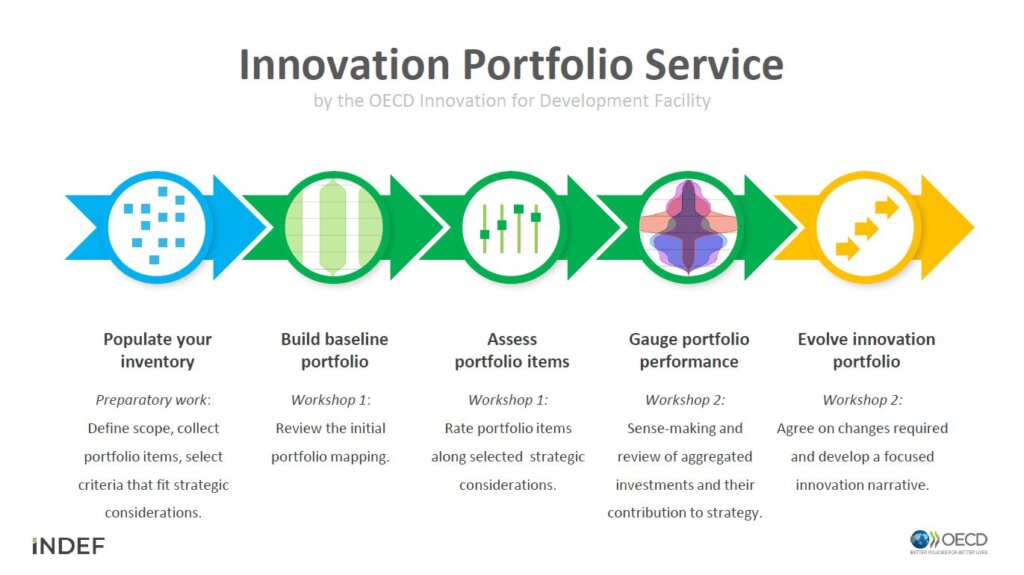

Recognizing the need for a tailored innovation portfolio management service for development organisations, OECD OPSI worked with and the OECD Development Co-operation Directorate (DCD) Innovation for Development Facility to develop a service to help international development organisations unlock the potential of their innovation portfolios. The service was designed to increase the impact of development assistance as well as increase innovation within development organisations, including adopting new ways of working and scaling promising innovations.

Through a series of “service moments”, the OECD guides development organisations through key strategic discussions to establish and support a sustained innovation management practice. These service moments include:

There is no one-size-fits-all portfolio model. Instead, recognising commonality and differences, we designed the structure of an international development organisation portfolio around “base criteria” (common to all) and “custom criteria”, based on the unique needs, purposes, institutional setups, and missions of individual development organisations. Together, they define and guide strategic discussions and lead to a tailored portfolio. To start, each portfolio item is organised according to the (common) base criteria:

- Funding volume: the amount in USD allocated to each item.

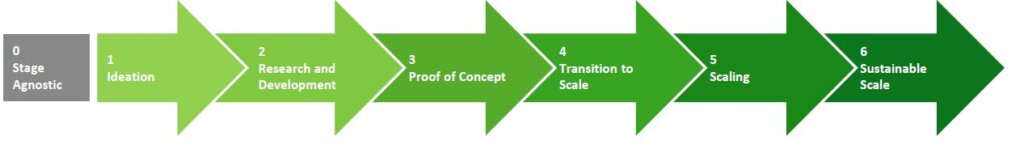

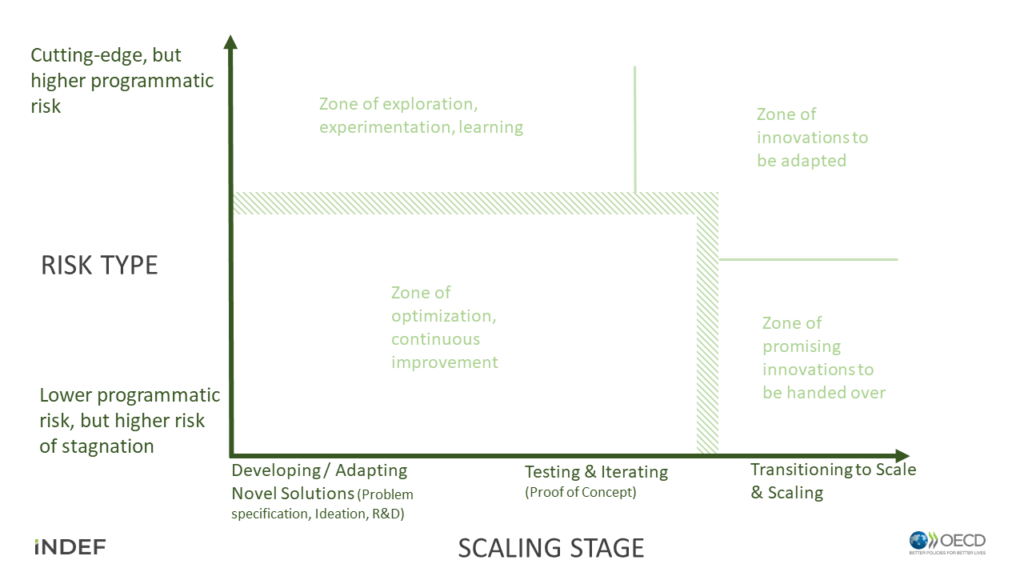

- Scaling stage: stretching on a continuum from ideation to sustainable scale, based on the International Development Innovation Alliance framework which puts forward a shared vocabulary for innovation funders. The entire service puts an emphasis on scaling, acknowledging that this is a multi-year, non-linear process.

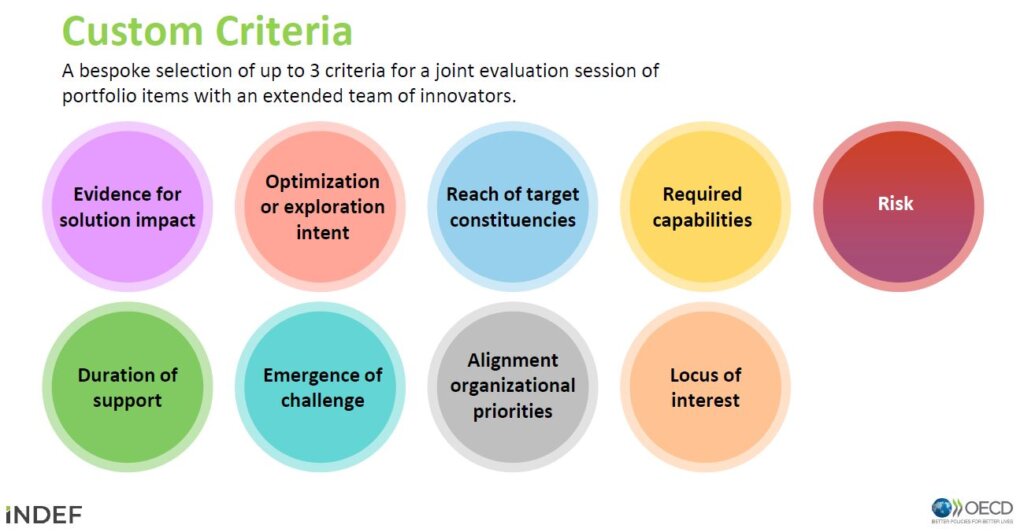

Subsequently, based on the priorities, comparative advantage and institutional setup of each development organisation, a set of “custom criteria” are defined through a strategic dialogue between the OECD and the development organisation. This conversation can be quite illuminating for organisations and make hidden drivers and priorities visible among the team co-ordinating innovation efforts. Our collaborations with development funders demonstrated that the review and prioritisation of these custom criteria is a way to accelerate innovation strategy processes in organisations. The OECD catalogue of “custom criteria” draws on development innovation research, including from the COVID-19 pandemic response, and a consultation with members of the OECD Development Assistance Committee.

These custom criteria include:

As part of the service, we ask stakeholders from Foreign Ministries, Development Ministries and implementing agencies to assemble a core team of stakeholders: professionals with decision-making power over innovation investments and strategy, and with an interest to enhance the organisation’s strategy. This group reviews and selects the custom criteria and leads the mapping process. Portfolio mapping requires a broad framing of innovation and consultation across the organisation to identify items to add to the portfolio. Therein, portfolio items are seen as programmes focused on innovation or composed of innovative components which stakeholders assess against their scaling stages. Often, this is the first explicit reflection on what “appropriate scale” might mean for the individual programme and how a business model for sustainable scale might look like.

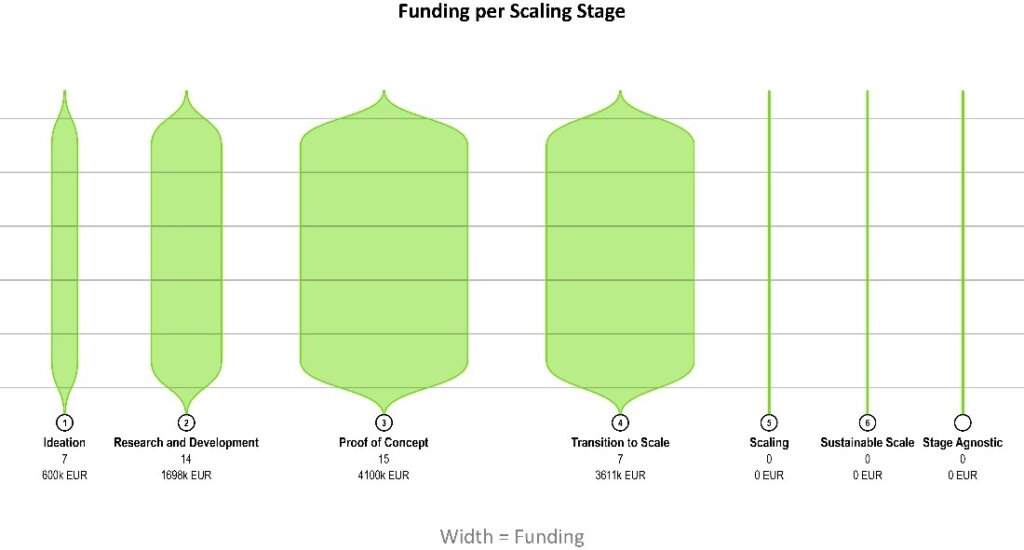

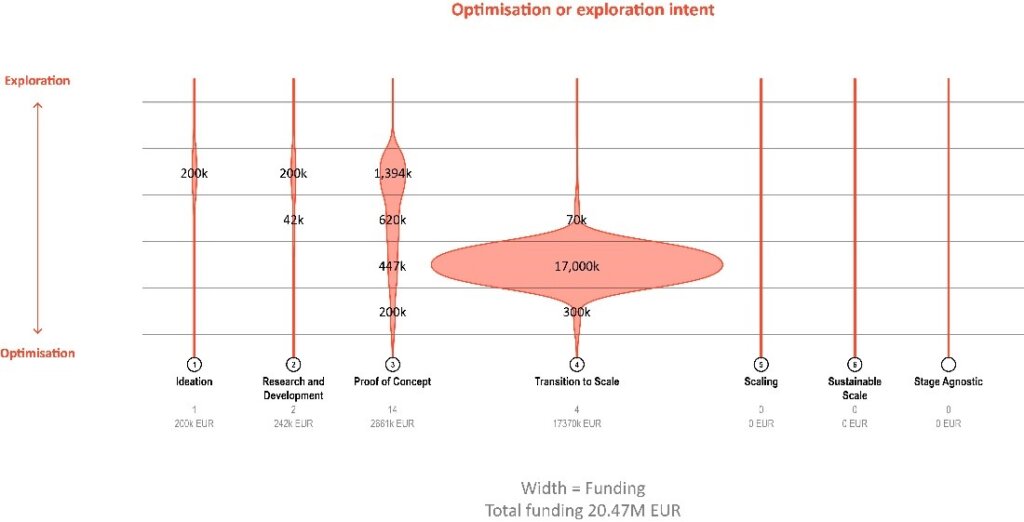

The first picture that emerges is where funding is allocated against scaling stages. Here is an illustrative sample of a portfolio that is made up of 43 projects:

The scaling stages and selected custom criteria provide a snapshot of where investments are currently oriented. This ‘view from the balcony’ is mainly intended for strategic reflection, as opposed to accounting. One common pitfall is that, in an attempt to be comprehensive, programme managers include too many programmes, while truly innovative work is discounted.We found that the assessment of the scaling stages is often the first engagement of programme managers with the complex challenge of designing pathways for appropriate and sustainable scale, and thus likely to result in assessments that might not always be accurate. However, we learned that the insights gained are sufficiently accurate to trigger rich discussions about the suitability of the current portfolio against the strategic aims of the organisation. The process also serves as a capacity strengthening exercise for staff and partners with regard to managing for scaling. It also provides a forum for dialogue among stakeholders with differing perspectives regarding the intent of innovation projects, from staff members of a respective Ministry or organisation to key implementing partners from UN agencies, NGOs, academia and private sector organisations.

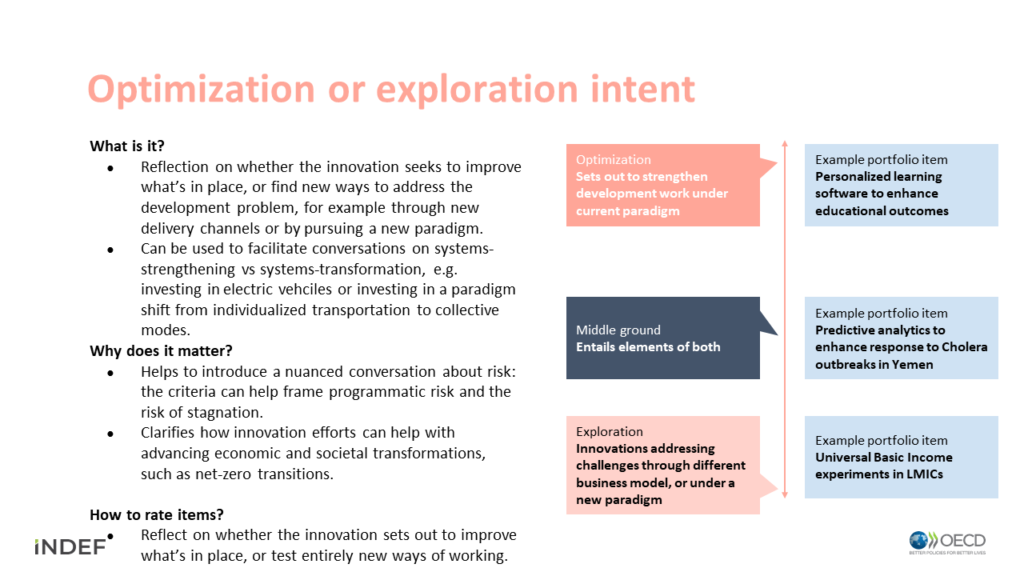

Following the selection of the custom criteria, participants of the workshops are asked to assess all programmes, all portfolio items, against these criteria. For example, stakeholders may be asked to assess whether the intent of a specific portfolio item is to optimise or explore. We designed all custom criteria in a way that emphasizes that any focus is a relevant one. This reflection serves to establish strategic clarity of the individual portfolio items, a picture of the portfolio distribution and thus, an understanding of how well it might be balanced.

Based on a collective assessment of the portfolio items against the base and custom criteria, we develop visualisations to guide conversations about the current performance and future direction of the portfolio. See a hypothetical example below, outlining where funding is located (width of the bubble) at the different scaling stages, based on its focus on optimization or exploration. This visual is the result of the joint assessment of all portfolio items, undertaken by stakeholders that participate in the workshops we lead:

The “so what?” moment

A key part of our service is to guide colleagues through sense-making discussions in light of the visualised portfolio distributions. For example, participants are asked to develop recommendations in small groups: whether to maintain the current distribution of a portfolio, to diversify or shift. We then distil insights and develop portfolio briefs to summarise the intelligence surfaced and propose recommendations, based on our insights. These briefs also include a custom portfolio model, based on the custom criteria (i.e. the strategic aims of the respective development organisation, its future ambitions, the distinct types of innovations which the organisation would like to manage). This model can serve as a reflection and financial planning tool. It can be added to regular annual or bi-annual portfolio review processes and inform funding decisions of new programmes and initiatives. This logic suggests not one pathway for better development outcomes, but several portfolio logics. Learn more how this can look in practice in the upcoming part 2 of this series.

The collaboration between OPSI and the Development Co-operation Directorate Innovation for Development Facility has yielded a promising service to support development organisations to better visualise, analyse, and transform their innovation portfolios based on strategic intentions and the desired impact of development investments. The innovation portfolio service reveals a different understanding of what innovation is, why it is relevant and how it can be measured across the funder and implementing partners. The utilisation of this framework and the portfolio model aim to open new types of conversations to more intentionally direct innovation activities and investments, and to help better practices for appropriate and sustainable scale.

The service supports development funders and organisations with developing more effective ways to manage innovation portfolios that span across thematic areas and geographies. As a next step, we plan on developing a Playbook for this methodology and work with partners on innovation portfolio approaches for portfolios that pursue a shared strategic intent, such as a net-zero transition strategy in a low or middle-income country.

In the upcoming part 2 of this blog post, we will describe how this approach has been used with the Ministry of Foreign Affairs in Iceland to build up their innovation portfolio capacity.

If you would like to know more about the details of this service and its methodology or if you work on innovation portfolios overall, please get in touch with us via [email protected]!