As more services digitalize, there is a need for high assurance digital identity; to empower our citizens to transact digitally by providing them with a convenient and secure digital identity; to digitally enable government and businesses to digitalize their operations and capture new opportunities by providing a series of trust services in the form of APIs; and to create an ecosystem of trust so as to promote trusted data flows. Citizens, government, and businesses have benefited from Singpass.

Innovation Summary

Innovation Overview

Singpass, Singapore’s national digital identity (NDI), is the cornerstone of the country’s Smart Nation vision. As a foundational digital infrastructure, NDI has created endless possibilities for government and businesses to provide innovative and user centric digital services, basing off APIs made available by NDI.

What started off as an identity and access management system for government services, has grown into an ecosystem of products and services adopted by 97% of the population who are at an eligible age to use Singpass. This is possible because the team tirelessly focus on users’ needs, prototype, and improve the product offerings iteratively.

Login; verifies users’ identity online in a secure and trusted manner when transacting online. The initial problem to solve was to ensure secure authentication, while not overburdening the user with multiple user ID and passwords to remember. The Singpass app was introduced to hold a soft token within the users’ mobile device. Users will secure the access through authentication methods consistent with how they would unlock their phone. When users want to access services on any device, a QR code will be presented to them, where they can scan the QR with Singpass app for authentication. Today, Singpass is used by about 2,000 services from both public and private sector. Enabling users to access transactional services seamlessly in a secure manner.

Myinfo; consolidates data that government have of users from various single source of truth. These data are released to public and private organisation based on the respective users’ authorisation. The product started with the objective of users having to only “tell government once” when updating information. This brings substantial conveniences to users because they no longer have to update agencies individually (e.g. change of postal address). Since these data are verified by the government, users can choose to apply these data (with their authorisation) when they transact with the private sectors. This has significantly simplified customer onboarding for private sectors. For example, with Myinfo, banks are able to complete the KYC process automatically. This saves banks about $50 per transaction and has reduced transaction time by about 80%. User satisfaction of these services has also improved noticeably.

Identiface; provides a stronger method of authentication by matching users’ selfie captured during transaction with the latest enrolled facial image recorded with the Immigration and Checkpoint Authority. With robust presentation attack detection, Identiface has been used for secure onboarding of users to Singpass app. This has reduced waiting time by about 10 min. Identiface was recently used in collaboration with banks to disburse money to unbanked beneficiaries of various government support schemes through ATM.

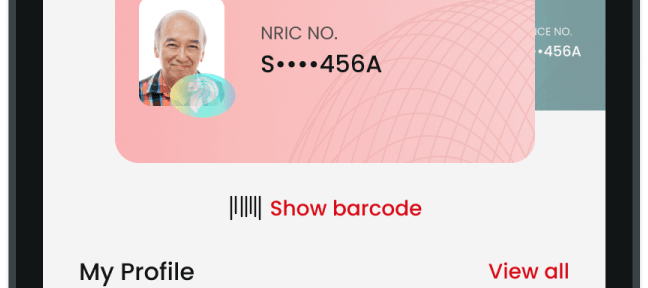

Verify; enables users to release verified data when performing in-person transactions. The benefits of Myinfo have inspired the team to provide equivalent service in a physical setting. By scanning a QR code or tapping on the NFC device, data can be released to the relying party with the users’ authorisation. This replaces the need for users to have to prove their identity by showing their identity card at counters. Only required information is released in a privacy preserving manner.

SafeEntry; During the recent pandemic, Verify was pivoted within a short period of time to support contact tracing. Visitors to buildings used to have to pen down their contact details in a logbook where Ministry of Health (MOH) will use it to reach out to people who may have been in close contact with a patient who has recently visited the premise. With SafeEntry, visitors just have to scan a QR code as they enter the building. Data is stored away without requiring any staff to handle. When needed, MOH was able to retrieve the contact details immediately, without having to send someone down to collect logbooks.

Sign; seeks to digitalise transactions that still require wet ink signature by providing secure electronic signature capabilities for all Singpass users. Working with the ecosystem of document signing applications, Sign with Singpass allows users to apply signature on e-documents using their preferred third-party digital signing tool that are compatible with Singpass and compliant with Singapore’s Electronic Transactions Act.

Notify; provides a platform for government to reach out to citizens quickly and securely. Messages from various government agencies can be pushed to users through the Singpass app. They are classified in a user centric manner so that it is easy for users to differentiate which are those that require action, and which are those that are informational.

A study done with Deloitte projected that Singpass suite of products is generating an economic impact of about $385 million. It is assessed that when fully adopted, it can potentially deliver an annual economic impact of over $1 billion.

Innovation Description

What Makes Your Project Innovative?

Singpass aims to provide growing opportunities for digitalization and value creation to the everyday lives of residents and businesses by enabling end to end digital transactions.

What make Singpass innovative is that we managed to:

1. create an ecosystem of trust that has enabled other public and private organisations to rely on and further innovate to deliver wonderful services to users.

2. build a product platform that can iterate rapidly to meet evolving needs within a very tight timeline (SafeEntry to support contact tracing)

3. eliminate the need for multiple online identities and passwords, through the use of Singpass authentication methods (Login, Identiface, Verify)

4. empowers users with greater and more convenient access to their own data, allowing personal and corporate data to only be shared upon explicit consent using Myinfo

5. Enable trust services through digital signing, remote authorisation of transactions and digital credentials stored in a digital wallet.

What is the current status of your innovation?

Ever since Singpass rolled out the various Singpass APIs (e.g. Myinfo, Face Verification), we see a steady growth for adoption of both public and private sectors adopting the Singpass APIs services. We are working closely with them to gather feedback in order to improve our products in the next iterations. Besides the key sectors (i.e. financial, healthcare, social sectors) adopting Singpass APIs, we intend to expand on more use cases to maximise the economic impact.

Besides gathering feedback from public and private sectors, the team also keep track of the comments from citizens regarding their user experience with Singpass. We keep a conscious effort to continue talking to users to understand their needs, collecting data and iterate to improve.

Innovation Development

Collaborations & Partnerships

Singpass has partnered many organisations in across multiple sectors, specifically the financial and healthcare. These sectors have adopted the Singpass platform, a common and universal digital identity that is of high assurance. Our adoption and partnerships extend beyond our shores and out towards our goal for cross border interoperability. We are working with several other countries such as Australia and the UK to collaborate and work towards mutual recognition of each nation digital identity

Users, Stakeholders & Beneficiaries

With Singpass, citizens and residents are able to transact with both public and private sector conveniently and securely online with a single digital identity. They are also able to access their documents and credentials through the Singpass app document and identity wallet respectively. Both public and private sectors are able to focus on their core business by adopting Singpass APIs. For example, organisations need not maintain their own authentication systems by leveraging on Singpass Login

Innovation Reflections

Results, Outcomes & Impacts

Singpass has largely impacted organisations, since on-boarding to Singpass APIs, businesses have reported:

• 97% usage by eligible residents

• 80% reduction in transaction time for digital transactions

• 10 mins reduction in waiting time through the use of Singpass Face Verification.

• up to S$50 savings for financial sector companies to acquire each customer online using Singpass Myinfo

• 15% increase in approvals due to better data quality

An independent study done by Deloitte has estimated the current economic impact of Singpass to be $385 million. What is even more exciting is that the potential economic impact can be above $1 billion, when new and existing product and features have been adopted by various sectors.

Challenges and Failures

Data privacy and protection is a key principle when designing Singpass. While fulfilling the need for expediency and easy to use digital services, we ensure that it does not undermine the trust that the people have given us. In tackling this challenge, the team works closely with Singapore’s Personal Data Protection Commission to ensure the trust and safety of the data being used. The Singpass team has taken to heart the culture of consent, in giving the control to the individual to decide whether or not to give access and control of data.

With the rising rate of scams, this is an area of challenge that Singpass is currently facing. We are continuously improving our security posture and at the same time, pivoting our operations to prevent scams and respond quicker when scams take place.

Conditions for Success

There must be value for all parties relying on Singpass, where there’s useful features and digital services from both public and private sectors relying on our platform; and there is sufficient reach to the consumers to make it worthwhile for these organisations.

There’s need to be trust, trust in the Singpass platform, trust that the platform is reliable and trust that citizens’ privacy is being preserved when using the platform.

We have challenged ourselves not to leave anyone behind. We’ve identified many different user groups and edge cases that we needed to design for, not just the tech-savvy majority. The team has been making extra effort to co-create with the elderly and people with disabilities, whether permanent, temporary or situational. We are working with various government agencies to recruit seniors/elderly with a passion for technology to be our ambassadors, to help build digital literacy among seniors and other less digital-able groups in their communities.

Replication

Singpass enabled COVID-19 contact tracing through SafeEntry. SafeEntry was rolled out within 3 weeks and enabled across 200 thousand venues islandwide with over 300 million transactions each month. This allowed residents to go about their daily lives.

Singpass was also extended to SGFinDex – Singapore’s opening banking data ecosystem. It is the world’s first public digital infrastructure that allows a person to sign-in using his national digital identity and provide consent to obtain his financial information from different financial institutions and government agencies. This allows residents to consolidate their personal balance sheet securely and conveniently from our major banks, stock exchange and major life insurers.

And also subsequently to SGTraDex, a data highway which enables digitalization of the supply chain industry and by enabling stakeholders to “plug and play” to exchange data in a secure environment which optimizes planning and decision making in the ecosystem.

Lessons Learned

The technology and trust landscape are ever evolving, from our experience, we observed that is it beneficial when share and learn from technology partners, our partners who are relying on our services and also other government counterparts.

Project Pitch

Supporting Videos

Status:

- Diffusing Lessons - using what was learnt to inform other projects and understanding how the innovation can be applied in other ways

Date Published:

16 November 2022