The digital compensation scheme was created to support Norwegian businesses to endure the financial consequences of the Covid-19 pandemic. The scheme designed was quick, efficient, and can be relaunched when needed. Checks are done before the disbursement, which minimizes the need for verification afterwards and also prevents misconduct. Applications are approved by an auditor, and then automatically processed and checked against information from a variety of sources and registers. Information about grants was published every hour and applicants would receive a reply within minutes, and payout within 72 hours.

Innovation Summary

Innovation Overview

The Covid-19 pandemic and the authorities' infection control measures had substantial financial consequences for Norwegian businesses and industries. Norway's Government therefore established a broad, temporary compensation scheme for fixed and inevitable costs, which later also included loss of goods such as perishable foods. The compensation scheme applied to the period from 1 September 2020 to 28 February 2022. The Ministry of Trade, Industry and Fisheries gave the Bronnoysund Register Centre (BRC) the responsibility for developing and managing the scheme. BRC was the grant authority and thus responsible for establishing requirements regarding checks, which the auditor or authorized accountant must perform when verifying the information provided by the applicant. The key objective for the initiative was to prevent bankruptcy, unemployment, and stagnation in the Norwegian economy.

The scheme was based on common IT-solutions as Altinn and the new register platform developed by BRC, and with approval by an auditor or authorized accountant in advance of admitting the application. When the application was submitted into our system, it went through an automated process to check if the applicant met the conditions according to regulations. This enabled us to avoid spending great resources on checking applications afterwards, or reclaiming payments based on false documentation by the applicants. If the applicant met the terms, the application would be automatically processed in just a few minutes, and they would have their grant in their account within 72 hours at the latest. In total, 45000 applications have been processed. 97 percent of the applicants that met the terms received their grant in their account the same working day or the day after the application was submitted.

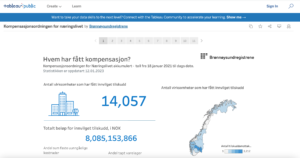

The scheme was developed in less than nine weeks, together with the regulatory development. The law that regulates the scheme was approved by ESA and the Norwegian government only hours before the deployment of the scheme. Agile system- and regulatory development methodology was used during the project and the project had a very slim project management. Enterprises that received grants via the compensation scheme were announced within minutes after their application was approved. Information about the enterprise and the amount of compensation received were published in our searchable online transparency database. The names of the audit or accountancy firms that verified the information in the applications were also included. It was a clear strategy to publish as much information as possible (https://public.tableau.com/app/profile/brreg/viz/Kompensasjonsordningenfornringslivet/Story1).

We also cooperated with The Norwegian Institute of Public Accountants and Accounting Norway on a user service per phone, where they acted as support on more complicated questions. More complex applications which required a more extensive review were sent to two auditor companies. Cooperation between government and the private sector has been a key to success. In addition to re-use of common IT-solutions and the "once-only" principle. One innovation is the automated checking of applications beforehand, thus avoiding spending great resources reviewing them afterwards and pre-empting attempted fraud. This has not been done before by governmental bodies in Norway.

Innovation Description

What Makes Your Project Innovative?

Usage of the shared public trust-infrastructure in Norway to pre-check applications as well as in guidance is new, as well as the use of external auditors to do checks and the ability to scale up. Also the automated checking of applications beforehand, as described above, was one of the most innovative aspects of the scheme. The project invented a new risk model, where different sources combined is seen as a risk model to stop applications that was not eligible. In case of suspicion during the automated check, the scheme was sent to manual review. Furthermore, the new register platform BRsys enabled fast development of services and almost immediate payment to approved applicants.

What is the current status of your innovation?

The scheme itself was closed in February 2022, since this was a temporary scheme during the pandemic. However, it has already been a model for another scheme during the pandemic, the Compensation Scheme for Entry Quarantine Expenses. We released this solution in May 2021. It is also possible to relaunch the Compensation Scheme if necessary, as the model and cooperation method are also applicable in other types of services.

Innovation Development

Collaborations & Partnerships

The Ministry of Trade, Industry and Fisheries was responsible for the scheme. The Norwegian Digitalization Agency (Altinn), The Norwegian Institute of Public Accountants and Accounting Norway engaged in close cooperation through the whole process. The Norwegian Tax Administration, Økokrim (National Authority for Investigation and Prosecution of Economic and Environmental Crime) provided the initial scheme/web page, and sources to prevent fraude. Bits AS Finanstilsynet/Financial Supervisory Authority of Norway also collaborated.

Innovation Reflections

Results, Outcomes & Impacts

More than 14000 Norwegian enterprises have been granted over eight billion NOK through the scheme. This contributed to an increase of 13 percent in new enterprises, as well as a decrease of 18,9 percent in bankruptcies in 2021. Applications were processed within minutes, and in most instances, enterprises would receive grants the same day.

Challenges and Failures

Tight deadlines was a significant challenge, as many enterprises were affected by the imposed restrictions. Government, parliament, media and organizations had high expectations and the enterprises needed a scheme as soon as possible. Thanks to the close cooperation, we were able to make quick decisions and develop the scheme within short time. We were also affected by restrictions. Many employees worked from home and cooperated through digital platforms. Nevertheless, we managed to cooperate closer than ever. The solution has managed several changes in regulations, more than 30 releases with regulatory changes, including three different ESA regulations.

Conditions for Success

Trust-based leadership, a sence of urgency and motivation to make a difference. Another important condition was that we have cooperated with each other for many years, and could benefit from these relations.

Replication

Our innovation has already been a model for another scheme during the pandemic: The Compensation Scheme for entry quarantine expenses. We released this solution in May 2021. URL for web page: https://innreisekarantene.brreg.no/en/. It is also possible to relaunch the Compensation Scheme if necessary, and the model and cooperation method are applicable in other types of services.

The Office of the Auditor General in Norway indicated that the model of the compensation scheme is sustainable, and as such should be re-used in similar cases where compensation payouts is needed. To implement such a scheme in the future would now be a relatively quick solution given the success of the Covid-19 compensation scheme and our experience in developing it. This includes digital guidance, payment, and the publication of searchable public data pertaining to the scheme.

Lessons Learned

- Let the ministry observe the development closely, to highlight opportunities and limitations.

- Clearly defined roles are elemental.

- If we knew how long it would last we would have organized differently (many tired people, small project group).

- Our employer had the courage to go for it, and we benefited from high levels of trust both inside and outside our organization.

- We learned a lot from the first scheme developed by the tax authorities and found we needed a different approach.

- As a small state agency we rely on cooperating with others in order to solve our tasks. We used our relationships with partners in new ways.

- We invited local business to test the scheme before release.

- Public-private partnership develops relations and increases trust.

- Teams and digital dialog was an effective way of cooperating.

Project Pitch

Status:

- Evaluation - understanding whether the innovative initiative has delivered what was needed

- Diffusing Lessons - using what was learnt to inform other projects and understanding how the innovation can be applied in other ways

Date Published:

23 November 2023